Services

Corporate Governance Framework

Every company needs a good corporate governance in place to encourage transparency, productivity, and sustainability. At PI, we assist clients to achieve effective corporate governance by designing a constructive corporate governance framework that will include - but not limited to:

- A code of ethics format directed towards internal stakeholders, to encourage acting with honesty, integrity, and in good faith.

- A board charter structure that clarifies the roles, duties and powers of directors and management.

- Board composition and structure that ensures a balance of skill, experience, and independence.

- Inductions for independent and non-executive directors.

- Establishment of board committees and their charters.

- Reporting packs to ensure disclosure of accurate and relevant information to company owners.

For further queries about our services you may feel free to:

Risk Management & Internal Audit

Effective risk management and controls are essential to protect a company’s assets and minimize errors and failures. We help clients design robust and proactive risk management and internal controls frameworks.

Our internal audit approach:

- Preserve the value of the company by monitoring business operations, processes and governance and ensuring compliance with reporting standards and market regulations.

- Add value through consulting, supporting leadership in strategic planning, improving controls, integrated risk management, tax planning and strategy.

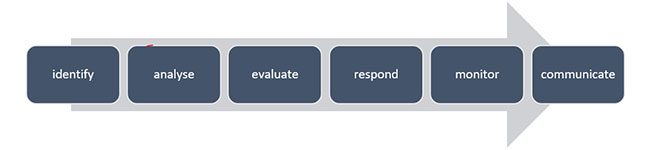

Our approach to risk management:

We design a robust risk management framework for our clients based on the latest pronouncements on COSO’s Enterprise-wide Risk Management (ERM) framework to consider the organization’s risks and opportunities relating to the company’s finance, operations, and objectives. As a result, strategic decision-making is within the company’s risk appetite. Our Risk assessment structure will include:

- Developing a risk identification matrix to identify the different risk areas.

- Analysing risk strategy and planning by understanding the risk appetite and necessary measures.

- Evaluating the likelihood of risk and the severity of impact on the company.

- Looking at possible responses to risks: ‘treat’, ‘transfer’, ‘accept’ or ‘avoid’ the risk.

In addition to the above, we also assist our clients in uprooting the causes of financial wrongdoings through:

- Mining data from transactions, cash movements, and ancillary documents to recognise abnormal patterns or trends.

- Using modern tools and technology to investigate the cause of the abnormal activity, the people involved, and map the entire flow of funds.

- Organising supports and evidence to present a detailed report of the analysis.

For further queries about our services you may feel free to:

Business Process Re-Engineering (SOPs, DoAs, SLAs, JDs)

All organisations need efficient business processes and procedures to deliver consistent, high-quality products/services. Unlike the one-size-fits-all approach, our approach involves analysing the business requirement and understanding and prioritizing their needs. We equip our clients a comprehensive BPR Pack that includes:

SOP

Based on our understanding and clients’ requirements, we look at their operations activity-wise (O2C, H2R, P2P, etc.) and function-wise to develop effective and efficient Standard Operating Procedures (SOPs). As a value addition, we also identify gaps and control weaknesses in the As-Is processes & procedures to recommend solutions.

Our SOPs include:

- BPMN-compliant flowcharts covering end-to-end processes

- Detailed narratives cross-referenced with the flowcharts.

- Standard forms, applications, letters as required in each process.

- Appropriate system snapshots and annexures to provide the necessary guidance.

DOA Matrix

A Delegation of Authority (DOA) matrix allows senior management to delegate duties between various decision-makers effectively. We provide clients with a clear structure of responsibilities and their allocation, resulting in a more productive environment.

We follow the Responsibility Assignment Matrix model (RACI) for efficient allocation of employees in cross-functional projects or processes. Our approach includes:

- Establishing persons for ‘Responsible’ and ‘Accountable’ roles is mandatory to be assigned.

- Ensuring only one staff member is assigned to ‘Responsible’ and ‘Accountable’ roles prevents ambiguity from lack of segregation of duties.

- Ensuring 2-way communication channels with the ‘Consultant’.

- Informing the relevant stakeholders to encourage a smooth workflow.

SLAs

An entity may come into an agreement with 1 or more parties to either receive or deliver a level-of-service given reasonable consideration (adequate payment). PI ensures that no party has an unfair advantage over another, and the SLA contract is being utilised to its potential.

We look at 2 types of SLAs:

- Internal SLAs for agreements between a company’s department, or function

- External SLAs with suppliers, service providers, customers, and other external stakeholders

Our SLA approach include:

- Clear and concise purpose of contract

- Detailed scope of services provided and limitations

- Roles and responsibilities of all parties

- Performance metrics: Quality, Responsiveness, Volume, Efficiency & Cost-Benefit Analysis

- Penalties for breach of contract and Indemnity clauses to protect individual/entities’ rights.

JDs

A great company has great people. A job description ensures that you attract the right group of people needed. Our approach to building the best job description includes

- Performing Job analysis using current market data and research

- Understanding job tasks and responsibilities through SOPs

- Listing ‘Core’ knowledge, qualifications, and skills for the position

- Looking at Additional skills that aren’t mandatory to have but would be an ‘Added-bonus’ for the company

- Ensuring consistency of Job description & specifications with the DOA matrix

For further queries about our services you may feel free to:

Systems Diagnostics & ERP Implementation

Businesses need to maintain up-to-date systems and systems suitable to their operational model to deliver the best quality of service/product.

We carry out Systems Diagnostics to identify any weaknesses in the system, assess the stability, and analyse suitability to business needs.

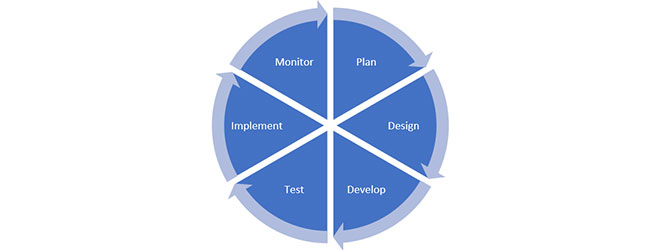

We ensure that the client uses the most compatible ERP systems to their business model. Our ERP implementation goes through 6 phases:

Our approach further explained:

- Assessing ERP needs based on organisation sector, business dynamics, management style and reporting dynamics, and reporting.

- Preparing detailed feasibility and shortlisting the ERP

- Meeting company needs and expectations with minimal disruptions

- Ensuring processes are control-embedded and required fields are included.

- Defining workflow management as per DOA

- Devising a consolidation mechanism including intercompany eliminations, if needed.

- Devising the required reports and implementing them as part of one-click reporting

- Assisting with BI reporting

For further queries about our services you may feel free to:

Cost Optimization

We help businesses to improve control over their costs by recommending ways to cut down expenditure and maximise overall business value. Our cost optimisation strategies will include:

- Cost review & rationalization

- Co-sourcing

- Right-sizing

- Salary benchmarking

- Process Improvement

- Technological Efficiency

- Departmental restructuring

We design benefit cards, for each strategy, to visualize strategy planning, complications, risks, and expected annual cost savings. As a value addition, we assist clients with change management that will involve managing internal and external stakeholders and establishing communication channels to ease the transition process. In doing so, we weigh the disrupt-ability of each recommended and approved change upon its expected benefit to prioritize low-hanging fruits first.

For further queries about our services you may feel free to:

ESG Implementation & Reporting

Growing stakeholder interests and demand for business sustainability calls for businesses to implement Environmental, Social and Governance (ESG) factors into their business model. We recommend ESG frameworks suitable for the client’s business model needs.

Our approach includes:

- ESG requirements as per industry, economic, social, and legal considerations

- Analysis of the company’s existing capabilities, such as corporate governance, HR, systems, and potential threats.

- Implementation of the framework through amended processes, special dashboards, SMART KPIs, training and more.

- Continuous monitoring and improvement following a well-devised plan for sustainability.

For further queries about our services you may feel free to:

Due Diligence

PI provides due diligence services to help clients make sound judgements for mergers and acquisitions.

We provide two types of services:

- Due diligence for buyers, through quality of earnings report, trend analysis, SWOT analysis, cash flow analysis, revised projections and more.

- Sell-side due diligence through pre-sale financial data analysis, cost and synergy analysis, consistency in accounting, and assist in preparing information memorandum and M&A data room.

Our detailed analysis will include:

- Building buyer confidence through a Quality of earnings reports

- Auditing and reviewing balance sheet items & accounting processes

- Analysis of working capital of the business

- Assurance of business compliance with tax legislation

- Identify the risks and opportunities of the company’s technology through IT due diligence.

For further queries about our services you may feel free to:

Investment Appraisals & Feasibilty Studies

Business investment decisions are crucial to a company’s long-term profitability & owner’s wealth. We design a financial model using client’s forecast statements and market data for cost-effective capital budgeting. Our in-depth financial analysis will include:

We also study the different areas of feasibility for a project to help the company make a sound judgement. Our areas of feasibility studies will include – but not limited to:

Technical

- Do you have enough resources?

- Are they well-equipped for the project?

- System Requirement

Economic

- Cost Benefit Analysis

- Can the company bear the cost of the project?

- What about unforseeable events?

Operational

- Will the project satisfy the business operations needs?

- Will it improve company reputation?

- How stakeholders feel about it?

Legal

- Will the project lead to a breach of law?

- Is there a breach ethics?

Schedule

- Can you complete the project within reasonable time-frame?

- What is the likelihood of completion?

For further queries about our services you may feel free to:

Business Valuations

A company may need to determine its economic value for sale, M&A, taxation compliances, partnerships, insurance, and divorce proceedings. Depending on the client’s business size, structure, and nature, our valuation techniques include:

For further queries about our services you may feel free to:

Completion Statements & Purchase Price Allocations

When finalising an M&A agreement, the buyer must carry out financial due diligence for the purchase price.

Our Purchase Price Allocation (PPA) approach help build client confidence which will include:

- Assessment of the seller’s Net Identifiable Assets Value

- Business Valuation for Fair Value of the seller’s company assets

- The Goodwill derived from the transaction (Goodwill = Purchase price – Fair Value of net assets)

For further queries about our services you may feel free to:

Mergers, De-Mergers & Aquisitions

Our highly experienced team works closely with clients during the two phases of Mergers & Acquisition (M&A): Pre-M&A & Post-M&A.

Our services will include:

Pre M&A

- Due Diligence

- Business Valuations

- Pre M&A environmental assessment

- Setting goals and objectives

- M&A Project Management

- Purchase Price Allocations

- Complete Statements

Post M&A

- Integration Planning

- Systems Integration

- Employee Hierarchy Restructuring

- Business Model Reshaping

- PPA accounting + Fair Value Adjustment

- Change Management

- Corporate Governance framework

- Tax Planning

A Parent company might want to divide one of their companies into two or more entities, either to operate independently from each other or to split off. Our experts collaborate closely with the client company to plan “De-Mergers” efficiently with minimal disruptions.

Our strategies include:

- Environment Assessment of current business state. Factors like Legal & Ownership structure, Financial, Corporate Governance, and Operations are considered.

- Strategic Roadmap with timelines and responsibilities

- Change management techniques for cost-effect and smooth transition process.

For further queries about our services you may feel free to:

IPO Readiness

When a company decides to go public, it goes through intensive strategic planning. PI helps clients through the preparation of the IPO process and ensures it meets the requirements to be successful.

Our IPO Readiness approach includes:

- Drawing a roadmap for the IPO process

- Establishing project team dedicated towards Pre-IPO, Preparation, Execution and Post-IPO phases

- Assessing and developing internal controls with compliance to SOX controls and identifying any system gaps.

- Defining the corporate governance structure and recognising any gaps

- Action plan for implementation of new controls, governance structure and pre-IPO audits

- Conducting Due Diligence

- Roadshows & Price offerings

- Public disclosures for financial reporting, Top Metrics, and other relevant data.

For further queries about our services you may feel free to:

We help businesses raise capital, according to their needs, by offering the best and most cost-effective financing solutions.

Debt Restructuring Advisory

We provide adequate solutions to help companies avoid bankruptcy. Our solutions help companies reduce interest rates and extend their debt repayments dates through debt-for-swap, risk-based haircut, and callable bonds.

Business Transformation

Cost Optimization

Cost Optimization Policies & Procedures

Policies & ProceduresFor further queries about our services you may feel free to:

Corporate Finance Solutions

Our corporate finance solutions allow companies to make decisions to increase capital and maximize shareholders’ wealth through solutions like:

- Structured & Syndicated loans

- Receivables backed loans & cashflow monetization

- Syndicated club facilities

- Shari’ah-compliant financing

- Project financing

- Acquisition & bridge financing

- Leveraged finance

- Dividend recapitalizations

- Real-estate finance

- Securitization & Asset-backed financings

For further queries about our services you may feel free to:

Trade Finance Solutions

Trade finance is crucial for businesses that trade internationally, and the company is associated with high foreign risks. We offer a full suite of trade financing solutions to address all needs from procurement to the realization of sales. Our products include but are not limited to:

- Letters of credit

- Import financing

- Guarantees

- Export financing

- LC discounting

- Account Receivables financing

For further queries about our services you may feel free to:

Structured Trade & Commodity Finance Solutions

Our team has rich structured trade finance capabilities, and we specialize in financing commodities producers and trading firms. We provide finance solutions to encourage growth and sustainability, such as:

Working Capital Facilities:

- Borrowing Base facilities

- Warehouse Receipt financing

Structured Commodity Finance:

- Pre-export Finance

- Pre-Payment Finance

For further queries about our services you may feel free to:

Outsourced Accounting Function

We help companies save costs and improve operational efficiency through first-class outsourcing solutions from our dedicated back-office support. Our approach to accounting outsourcing solutions include:

- Setting up accounting/ERP software as per client’s needs and considering factors like industry type, the scale of operations, geographical location, and tax regulations.

- Setting up charts of accounts using advanced cloud-based systems for the convenience and flexibility of the client.

- Data migration ensures the smooth transition of data from the existing system to the new system while maintaining data integrity and fixing any data anomalies in the process. We follow a 6-step process:

- Bookkeeping services with compliance to IFRS, US GAAP, local statutory requirements for disclosing accounting information.

- Payment processing for expenses and suppliers as per client approved mechanism.

- Daily reconciliation reports to point out and examine any variance in data.

- Periodic reconciliation for all major accounts and sub-ledger accounts.

- Meeting with operations and other relevant stakeholders for discussing reconciliation findings.

- Payroll processing through ERP and manual preparation of WPS.

- Month-end closing activities for accruals and amortization.

- Month-end reconciliation for all accounts and preparing and reviewing financial statements and KPIs.

- Periodic preparation of “Reporting packs” for management.

For further queries about our services you may feel free to:

CFO Outsourcing

We offer experienced CFO secondment services to strengthen strategic leadership, implement financial control and discipline, drive operational excellence, improve liquidity management and stakeholder management.

Our services will include:

- Long-term financial planning and budgets (aligned with growth schemes.)

- Periodic financial reports and assisting senior management with significant decision-making

- Cashflow management and optimizing Treasury function

- Managing relations with Strategic Creditor Management

- Overseeing accounting functions and supporting internal and external auditors by assuring accurate disclosure of information and compliance to the standards(IFRS, GAAP).

- Strategic financial planning advice to senior management.

- Advice on tax, internal control, and audit-related matters.

- Effective and efficient financial management through essential systems, policies, and procedures.

- Monitoring external contracts and services.

- Updated knowledge of market trends and behaviour.

For further queries about our services you may feel free to:

VAT Registeration & Filing

In the UAE, a company is obligated to register for VAT, given that they meet the mandatory registration threshold.

| Threshold | Taxable Supplies/Expenses |

|---|---|

| Mandatory | 375,000 AED |

| Voluntary | 187,500 AED |

At PI, we ease the registration and filing process through our expert advice, which will include:

- Applicability of the taxation law

- Impacts of tax to business model and processes

- Identifying gaps in the business’s resources(i.e., people, technology, cash)

- Registration with relevant tax authorities

- Assistance with VAT filing

- Mapping and amendment of existing processes and documents

- Support in implementation or modification in IT systems

- Accounting Services, if needed

- Training for VAT compliance and procedures

- Preparation of Tax policies and procedures

- Updates on alterations in VAT Law

- VAT cashflows management

- Managing VAT audits from authorities

- Tax avoidance schemes within legal boundaries

For further queries about our services you may feel free to:

Tax Planning & Advisory

Companies want to minimize their tax liabilities and avoid additional taxes. We give effective Tax Planning advice to our clients, so they enjoy the benefits of their business. Our approach ensures that we mitigate tax burdens within legal boundaries, that will include:.

- Short-term tax planning

- Long-term tax planning

- Tax credits, exemptions and deductions

- International tax planning

- Transfer Pricing Mechanisms

- Tax avoidance strategies

- Within legal limits

- Monitoring changes to tax law

- Corporate Restructuring

- Special Purpose Vehicle (SPV) Restructuring

- Off-balance sheet items

- Tax Risks

For further queries about our services you may feel free to:

Transfer Pricing & Advisory

Transfer Pricing arrangements are intercompany pricing contracts between multiple Multinational (MNC) groups. These MNCs exchange tangible goods, services, intellectual property and loans with foreign entities.

MNC Enterprises tax residents in the UAE with annual consolidated revenue of over AED 3.15 billion in their year-end, are obligated to practice OECD’s Arm’s Length Principle. The legislation was put into effect starting 1st January 2019.

Our approach to TP is to reduce the overall tax burden by exploiting gaps and mismatches in taxation statutes and laws for various jurisdictions.

For further queries about our services you may feel free to:

SPV Structuring

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

For further queries about our services you may feel free to: